2025 BNC Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: BNC's Market Position and Investment Value

Bifrost (BNC), as a scalable, non-custodial decentralized cross-chain liquidity staking specialized parachain built on Polkadot, has made significant strides since its inception in 2019. As of 2025, Bifrost's market capitalization stands at $4,176,075, with a circulating supply of approximately 47,710,216 BNC tokens, and a price hovering around $0.08753. This asset, often hailed as the "Liquidity Bridge for PoS Networks," is playing an increasingly crucial role in providing liquidity solutions for staking assets across multiple blockchain ecosystems.

This article will comprehensively analyze Bifrost's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. BNC Price History Review and Current Market Status

BNC Historical Price Evolution

- 2021: Reached all-time high of $6.14 on November 3rd

- 2022: Significant market downturn, price dropped to all-time low of $0.077236 on November 14th

- 2025: Continued price volatility, currently trading at $0.08753

BNC Current Market Situation

As of October 12, 2025, BNC is trading at $0.08753. The token has experienced a decline across various timeframes: -0.13% in the past hour, -1.87% in the last 24 hours, -14.7% over the past week, -15.77% in the last 30 days, and a substantial -54.08% over the past year. BNC's market capitalization stands at $4,176,075.25, with a fully diluted market cap of $7,002,400. The circulating supply is 47,710,216.49 BNC, representing 59.64% of the total supply of 80,000,000 BNC. The token's 24-hour trading volume is $59,543.67. Despite the recent downtrend, BNC is still trading above its all-time low, suggesting some level of market resilience.

Click to view the current BNC market price

BNC Market Sentiment Indicator

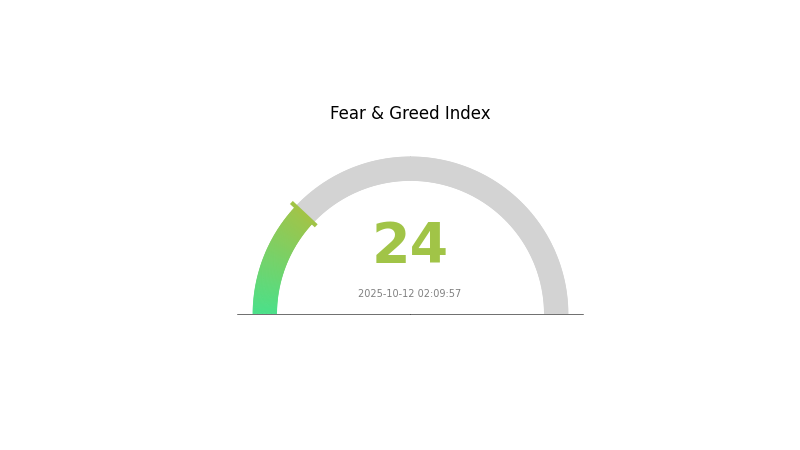

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 24. This level of pessimism often presents unique opportunities for savvy investors. While caution is warranted, historically, such extreme fear has preceded significant market rebounds. Traders on Gate.com are closely monitoring this indicator, as it may signal a potential turning point. Remember, successful investing often involves going against the crowd. Always conduct thorough research and manage risks wisely in these volatile times.

BNC Holdings Distribution

The address holdings distribution data for BNC reveals a relatively decentralized ownership structure. Based on the provided information, there are no addresses holding a significant percentage of the total supply, indicating a lack of concentration among large holders or "whales".

This distributed ownership pattern suggests a reduced risk of market manipulation by individual large holders. It also implies a more stable market structure, as no single entity has the power to dramatically influence the price through large sell-offs. The absence of dominant addresses contributes to a more equitable distribution of BNC tokens, potentially fostering a healthier ecosystem and reducing the likelihood of sudden price volatility caused by large holders' actions.

Overall, the current address distribution reflects a positive aspect of BNC's market characteristics, suggesting a higher degree of decentralization and on-chain structural stability. This distribution pattern may contribute to a more resilient market and could be viewed favorably by investors seeking assets with reduced concentration risk.

Click to view the current BNC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing BNC's Future Price

Supply Mechanism

- Token Economics 2.0: Implementation of the new token economic model will significantly impact BNC's price trajectory.

- Current Impact: The rollout of Token Economics 2.0 is expected to create upward pressure on BNC's price.

Institutional and Whale Dynamics

- Institutional Holdings: Companies like BNC Network Company (listed on NASDAQ) are making substantial investments in BNC, with BNC purchasing $160 million worth of tokens.

- Corporate Adoption: Increased adoption by traditional companies entering the crypto space through digital asset treasury models similar to MicroStrategy's approach with Bitcoin.

- National Policies: Regulatory approval, particularly in Japan, will play a crucial role in BNC's future price movements.

Macroeconomic Environment

- Inflation Hedging Properties: As a digital asset, BNC may be viewed as a potential hedge against inflation, similar to other cryptocurrencies.

- Geopolitical Factors: Global economic shifts and the push for financial inclusion in developing regions could drive BNC adoption.

Technological Development and Ecosystem Building

- Blockchain Architecture Upgrade: The development team is considering next-generation architecture aimed at achieving 100-1000x throughput improvement.

- AI Integration: Native support for AI applications is being planned, which could significantly increase transaction volumes and use cases.

- Cross-chain Applications: Expansion of cross-chain functionalities is expected to provide upside potential for BNC.

- Ecosystem Applications: Development of decentralized applications (DApps) within the BNC ecosystem, including DeFi protocols, NFT platforms, and Web3 services.

III. BNC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.07353 - $0.08000

- Neutral prediction: $0.08000 - $0.09000

- Optimistic prediction: $0.09000 - $0.10329 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.08636 - $0.1254

- 2028: $0.07433 - $0.16572

- Key catalysts: Project upgrades, market adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.14379 - $0.16895 (assuming steady market growth and project development)

- Optimistic scenario: $0.16895 - $0.19411 (with strong market performance and widespread adoption)

- Transformative scenario: $0.19411 - $0.21795 (exceptional project success and favorable market conditions)

- 2030-12-31: BNC $0.21795 (potential peak price in a highly bullish market)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10329 | 0.08753 | 0.07353 | 0 |

| 2026 | 0.1412 | 0.09541 | 0.05629 | 9 |

| 2027 | 0.1254 | 0.11831 | 0.08636 | 35 |

| 2028 | 0.16572 | 0.12185 | 0.07433 | 39 |

| 2029 | 0.19411 | 0.14379 | 0.09778 | 64 |

| 2030 | 0.21795 | 0.16895 | 0.15206 | 93 |

IV. Professional Investment Strategies and Risk Management for BNC

BNC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate BNC during market dips

- Stake BNC to earn additional rewards

- Store BNC in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Polkadot ecosystem developments closely

- Set stop-loss orders to manage downside risk

BNC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Polkadot ecosystem projects

- Utilize vTokens: Hedge staking risks while maintaining liquidity

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for BNC

BNC Market Risks

- Volatility: High price fluctuations typical of small-cap cryptocurrencies

- Liquidity: Potential challenges in executing large trades without significant slippage

- Competition: Emerging projects in the Polkadot ecosystem may impact BNC's market share

BNC Regulatory Risks

- Uncertain regulatory landscape: Evolving global regulations may impact DeFi projects

- Cross-chain compliance: Challenges in adhering to regulations across multiple blockchains

- Staking derivatives scrutiny: Potential regulatory focus on liquid staking products

BNC Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Bifrost protocol

- Interoperability challenges: Risks associated with cross-chain communication

- Scalability issues: Potential limitations as the network grows

VI. Conclusion and Action Recommendations

BNC Investment Value Assessment

Bifrost (BNC) presents a unique value proposition within the Polkadot ecosystem, offering liquid staking solutions. While it has long-term potential, investors should be aware of the high volatility and regulatory uncertainties in the short term.

BNC Investment Recommendations

✅ Beginners: Consider small, long-term positions as part of a diversified crypto portfolio ✅ Experienced investors: Explore staking opportunities and utilize vTokens for additional yield ✅ Institutional investors: Conduct thorough due diligence and consider BNC as part of a broader Polkadot ecosystem investment strategy

BNC Participation Methods

- Spot trading: Purchase BNC on Gate.com

- Staking: Participate in Bifrost's staking programs for additional rewards

- Liquidity provision: Contribute to liquidity pools on Bifrost's platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is BNC a good stock to buy?

BNC has a Moderate Buy consensus from analysts. It's currently rated favorably. Consider recent performance and market trends.

What is the BrainChip stock prediction for 2025?

BrainChip stock is predicted to reach an average price of $0.8748 in 2025, with a potential range of $0.4849 to $1.2646.

What is the price target for BNC?

The price target for BNC is $29.00 by 2026, based on analyst forecasts. This represents both the maximum and minimum estimate.

What meme coin will explode in 2025 price prediction?

A meme coin listed on major exchanges is predicted to explode, reaching a market cap of $860 million by October 2025, with an almost 8000% increase in value.

Share

Content