2025 DNX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: DNX's Market Position and Investment Value

Dynex (DNX), as a next-generation neuromorphic computing platform, has made significant strides in decentralized supercomputing since its inception. As of 2025, Dynex's market capitalization has reached $4,059,946, with a circulating supply of approximately 104,962,432 tokens and a price hovering around $0.03868. This asset, hailed as the "AI-powered blockchain revolution," is playing an increasingly crucial role in finance, medicine, construction, and military applications.

This article will comprehensively analyze Dynex's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. DNX Price History Review and Current Market Status

DNX Historical Price Evolution Trajectory

- 2024: DNX reached its all-time low of $0.002 on January 4, marking a significant bottom in its price history.

- 2024: The project saw a remarkable turnaround, achieving its all-time high of $1.23 on March 9, demonstrating explosive growth.

- 2025: DNX experienced a substantial correction, with the price declining by 89.87% over the past year.

DNX Current Market Situation

As of October 12, 2025, DNX is trading at $0.03868, representing a significant decrease from its all-time high. The token has seen a 9.09% decline in the last 24 hours and a 23.27% drop over the past week. The current market capitalization stands at $4,059,946.88, ranking DNX at 1848th position in the global cryptocurrency market. With a circulating supply of 104,962,432.3021125 DNX and a total supply of 104,976,612.4386533 DNX, the project has a relatively high circulating ratio of 95.42%. The 24-hour trading volume is $38,594.73, indicating moderate market activity.

Click to view the current DNX market price

DNX Market Sentiment Indicator

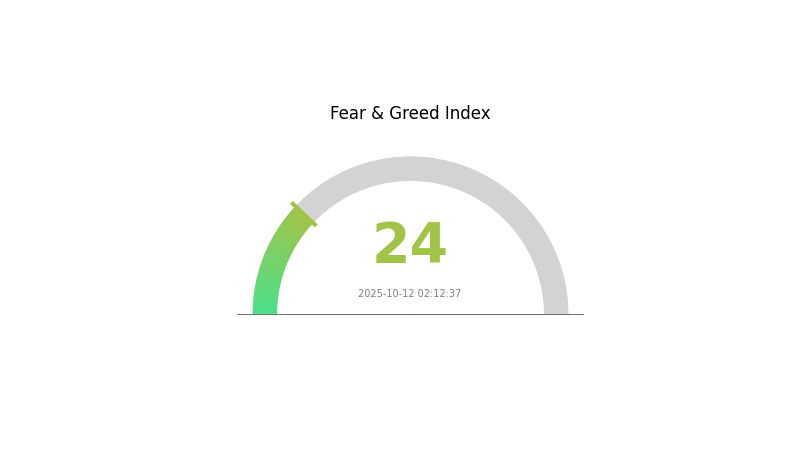

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at a low of 24. This indicates a highly pessimistic sentiment among investors, often presenting potential buying opportunities for contrarian traders. However, it's crucial to conduct thorough research and exercise caution in such volatile conditions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to manage risk effectively.

DNX Holdings Distribution

The address holdings distribution data for DNX is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. Without specific data on top holders and their respective quantities, it's challenging to assess the level of centralization or decentralization in DNX token distribution.

In the absence of this crucial information, we cannot evaluate the potential impact on market structure, price volatility, or the risk of market manipulation. The lack of visible data also prevents us from drawing conclusions about the on-chain structural stability or the overall decentralization degree of DNX.

Given these limitations, it would be prudent for investors and analysts to seek additional information from official DNX project channels or reliable third-party data providers to gain a clearer picture of the token's distribution landscape.

Click to view the current DNX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing DNX's Future Price

Supply Mechanism

- Market Demand: As with all cryptocurrencies, market demand is a core factor determining DNX's prospects. If the project attracts enough users and gains widespread application in real-world scenarios, the price of DNX could potentially rise.

Institutional and Whale Dynamics

- Corporate Adoption: The adoption of DNX by well-known enterprises could significantly impact its price.

Macroeconomic Environment

- Inflation Hedging Properties: DNX's performance in an inflationary environment could affect its price.

Technological Development and Ecosystem Building

-

Neuromorphic Computing Platform: Dynex (DNX) is a blockchain-based neuromorphic computing platform that utilizes PoUW miners to achieve high-speed, efficient computation. This technological foundation could influence its future price.

-

Ecosystem Applications: The development of major DApps and ecosystem projects on the Dynex platform could drive demand and affect the price.

III. DNX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03751 - $0.03867

- Neutral prediction: $0.03867 - $0.04022

- Optimistic prediction: $0.04022 - $0.04500 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.02991 - $0.05893

- 2028: $0.03293 - $0.06998

- Key catalysts: Broader crypto market recovery, increased adoption of DNX technology

2030 Long-term Outlook

- Base scenario: $0.06607 - $0.07104 (assuming steady market growth)

- Optimistic scenario: $0.07104 - $0.09661 (with strong DNX ecosystem development)

- Transformative scenario: $0.09661 - $0.12000 (with major industry partnerships and technological breakthroughs)

- 2030-12-31: DNX $0.09661 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04022 | 0.03867 | 0.03751 | 0 |

| 2026 | 0.04852 | 0.03944 | 0.03313 | 1 |

| 2027 | 0.05893 | 0.04398 | 0.02991 | 13 |

| 2028 | 0.06998 | 0.05146 | 0.03293 | 33 |

| 2029 | 0.08136 | 0.06072 | 0.05768 | 56 |

| 2030 | 0.09661 | 0.07104 | 0.06607 | 83 |

IV. DNX Professional Investment Strategies and Risk Management

DNX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate DNX during market dips

- Set a target holding period of at least 2-3 years

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to limit potential losses

- Take profits at predetermined price targets

DNX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options strategies: Consider using put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for DNX

DNX Market Risks

- High volatility: DNX price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to broader cryptocurrency market trends

DNX Regulatory Risks

- Uncertain regulatory environment: Potential for unfavorable regulations

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Possible limitations on global accessibility

DNX Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Challenges in handling increased network load

- Competition: Emergence of more advanced neuromorphic computing platforms

VI. Conclusion and Action Recommendations

DNX Investment Value Assessment

DNX offers exposure to the growing field of neuromorphic computing and AI, with potential long-term value. However, it faces significant short-term risks due to market volatility and regulatory uncertainties.

DNX Investment Recommendations

✅ Beginners: Consider small, experimental positions with a long-term horizon ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships

DNX Trading Participation Methods

- Spot trading: Buy and hold DNX tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities involving DNX

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is DNX crypto worth?

As of October 2025, DNX crypto is worth $0.047. Its market cap stands at $5 million, with a 4.85% decrease in the last 24 hours.

What meme coin will explode in 2025 price prediction?

A meme coin listed on major exchanges is predicted to explode, reaching a market cap of $860 million by October 2025, with an almost 8000% increase in value.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, forecasted to reach $139,249 at its peak. Chainlink follows with a predicted high of $59.67.

What is the future prediction for dent coin?

Dent is projected to reach $0.001136 by 2030, a potential 82.46% increase from current levels, based on long-term market trends.

Share

Content