2025 MAT Price Prediction: Bullish Outlook as Adoption Grows and Market Matures

Introduction: MAT's Market Position and Investment Value

Matchain (MAT), as an AI chain for ID and data sovereignty, has been onboarding over 500 million users via global IP partners using MatchID since its inception. As of 2025, MAT's market capitalization has reached $3,821,777.99, with a circulating supply of approximately 7,230,000 tokens, and a price hovering around $0.5286. This asset, known as the "AI chain for identity," is playing an increasingly crucial role in the fields of digital identity and data sovereignty.

This article will comprehensively analyze MAT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

I. MAT Price History Review and Current Market Status

MAT Historical Price Evolution Trajectory

- 2025 June: MAT reached its all-time high of $7.38, marking a significant milestone for the project

- 2025 August: The token experienced a sharp decline, hitting its all-time low of $0.2476

- 2025 October: MAT entered a recovery phase, with price fluctuations reflecting market volatility

MAT Current Market Situation

As of October 12, 2025, MAT is trading at $0.5286, representing a 17.25% increase in the last 24 hours. The token's market capitalization stands at $3,821,777.99, with a circulating supply of 7,230,000 MAT. The 24-hour trading volume has reached $664,514.65, indicating active market participation.

MAT's current price is significantly below its all-time high, suggesting potential for growth if market conditions improve. However, the token has shown resilience by maintaining a price well above its all-time low. The recent 24-hour gain of 17.25% demonstrates short-term bullish momentum, although longer-term trends remain bearish, with a 46.62% decrease over the past 30 days and an 86.89% decline over the year.

The token's fully diluted valuation of $52,860,000 indicates market expectations for future growth. With a circulating supply ratio of 7.23% to the total supply, there's potential for increased liquidity as more tokens enter circulation.

Click to view the current MAT market price

MAT Market Sentiment Indicator

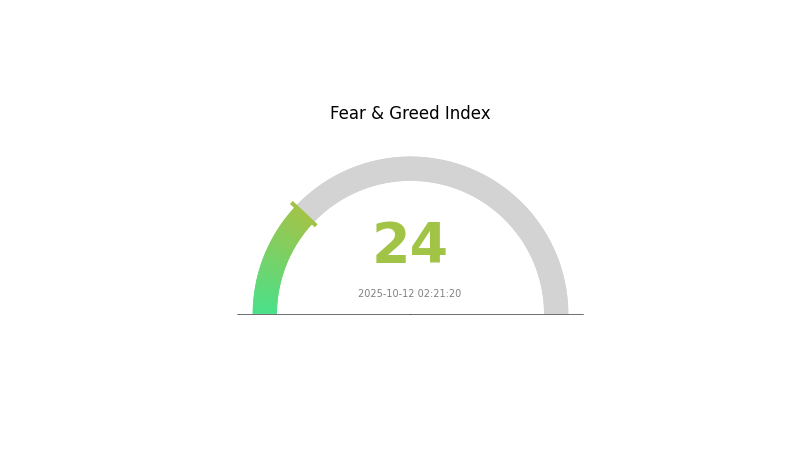

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 24. This level of pessimism often precedes potential buying opportunities, as per the contrarian investment strategy. However, caution is advised as market volatility may persist. Savvy investors might consider dollar-cost averaging to mitigate risks while capitalizing on potentially undervalued assets. As always, thorough research and risk management are crucial in navigating these turbulent market conditions.

MAT Holdings Distribution

The address holdings distribution data for MAT reveals a notable absence of significant concentration among top holders. This lack of data suggests a potentially highly decentralized distribution of MAT tokens across a wide range of addresses, which could be indicative of a healthy and diverse ecosystem.

Without clear evidence of large individual holdings, the current distribution pattern implies a reduced risk of market manipulation or sudden price fluctuations caused by the actions of major token holders. This dispersed ownership structure may contribute to enhanced market stability and resilience against potential whale-induced volatility.

Overall, the apparent wide distribution of MAT tokens reflects positively on the project's decentralization efforts and suggests a robust on-chain structure. However, a more comprehensive analysis would be necessary to draw definitive conclusions about the token's overall market characteristics and long-term stability.

Click to view the current MAT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting MAT's Future Price

Supply Mechanism

- Token Release: Most MAT tokens are yet to be unlocked. If future linear release is not controlled, it may cause price pressure.

- Current Impact: The extreme scarcity of circulating supply could lead to price volatility as more tokens enter the market.

Institutional and Whale Dynamics

- Corporate Adoption: Matchain (MAT) is positioned as the first Layer-2 AI platform on BNB Chain where users have full control over their digital identity and personal data.

Macroeconomic Environment

- Monetary Policy Impact: Global economic conditions, such as interest rate changes, inflationary pressures, and monetary policies, can influence capital flows between crypto assets and traditional markets.

- Geopolitical Factors: Policy decisions aimed at reducing dependence on China, concerns about national security, and the demand for more resilient supply chains may impact MAT's price.

Technological Development and Ecosystem Building

- AI Integration: Matchain leverages decentralized AI technology, setting new benchmarks for the future of Web3.

- Ecosystem Applications: As a Layer-2 AI platform, Matchain is contributing to the development of the Web3 ecosystem.

III. MAT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.34 - $0.45

- Neutral prediction: $0.45 - $0.52

- Optimistic prediction: $0.52 - $0.56 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.55 - $0.80

- 2028: $0.38 - $0.81

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.62 - $0.79 (assuming steady market growth)

- Optimistic scenario: $0.79 - $1.00 (assuming strong market performance)

- Transformative scenario: $1.00 - $1.10 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: MAT $1.09 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.56311 | 0.5214 | 0.34412 | -1 |

| 2026 | 0.63444 | 0.54226 | 0.4338 | 2 |

| 2027 | 0.80604 | 0.58835 | 0.55893 | 11 |

| 2028 | 0.80874 | 0.69719 | 0.38346 | 31 |

| 2029 | 0.83579 | 0.75297 | 0.50449 | 42 |

| 2030 | 1.09625 | 0.79438 | 0.62756 | 50 |

IV. Professional MAT Investment Strategies and Risk Management

MAT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate MAT during market dips

- Set price targets for partial profit-taking

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor key support and resistance levels

- Use stop-loss orders to manage risk

MAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Portfolio diversification: Spread investments across different cryptocurrencies

- Use of stablecoins: Convert part of MAT holdings to stablecoins during high volatility

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MAT

MAT Market Risks

- High volatility: MAT price can experience significant fluctuations

- Low liquidity: Limited trading volume may lead to slippage

- Market sentiment: Susceptible to overall cryptocurrency market trends

MAT Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on AI-related cryptocurrencies

- Cross-border compliance: Challenges in adhering to varying international regulations

- Data privacy concerns: Potential scrutiny due to AI and identity management features

MAT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Possible network congestion as user base grows

- AI integration issues: Risks associated with integrating AI technology with blockchain

VI. Conclusion and Action Recommendations

MAT Investment Value Assessment

MAT presents a unique value proposition in the AI and identity management space within blockchain. However, it faces significant short-term risks due to market volatility and regulatory uncertainties.

MAT Investment Recommendations

✅ Newcomers: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider MAT as part of a diversified crypto portfolio

MAT Trading Participation Methods

- Spot trading: Buy and sell MAT on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options as they become available for MAT

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Is MAT stock a good buy?

MAT stock shows potential with strong value metrics, but mixed growth and momentum signals. Current market trends suggest cautious optimism. Consider recent financial reports for a more informed decision.

What is the price target for MAT?

Based on analyst forecasts, the price target for MAT is $24.50, with a range from $21.00 to $24.50.

Which AI is best for stock price prediction?

Hybrid GARCH-LSTM models are best for stock price prediction, combining statistical properties with advanced AI for improved accuracy and reliability in forecasting future prices.

What does MAT stock do?

MAT stock represents Mattel, a company that designs, manufactures, and markets toys globally. They produce popular brands and sell to wholesalers and consumers directly.

Share

Content