2025 NAWS Price Prediction: Navigating the Future of Digital Asset Valuation in a Volatile Crypto Market

Introduction: NAWS Market Position and Investment Value

NAWS (NAWS), as a no-code platform for selling Web2, Web3 content, and DePIN vouchers, has achieved significant milestones since its inception in 2024. As of 2025, NAWS has reached a market capitalization of $4,978,428, with a circulating supply of approximately 1,996,162,100 tokens, and a price hovering around $0.002494. This asset, often referred to as the "Web3 Content Marketplace," is playing an increasingly crucial role in the fields of content creation and decentralized finance.

This article will comprehensively analyze NAWS's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. NAWS Price History Review and Current Market Status

NAWS Historical Price Evolution

- 2024: NAWS launched, price reached all-time high of $0.05262 on October 8

- 2024: Market correction, price dropped to all-time low of $0.0000801 on October 22

- 2025: Gradual recovery, price stabilized around $0.002494

NAWS Current Market Situation

As of October 11, 2025, NAWS is trading at $0.002494. The token has experienced significant volatility in the past 24 hours, with a price decrease of 30.64%. The trading volume in the last 24 hours stands at $152,622.79. Despite the recent dip, NAWS has shown positive growth over longer time frames, with a 22.5% increase in the past 7 days and a 19.1% gain over the last 30 days. The market capitalization of NAWS is currently $4,978,428, ranking it at 1731 in the cryptocurrency market. The circulating supply is 1,996,162,100 NAWS tokens, representing 19.96% of the total supply of 10 billion tokens.

Click to view the current NAWS market price

NAWS Market Sentiment Indicator

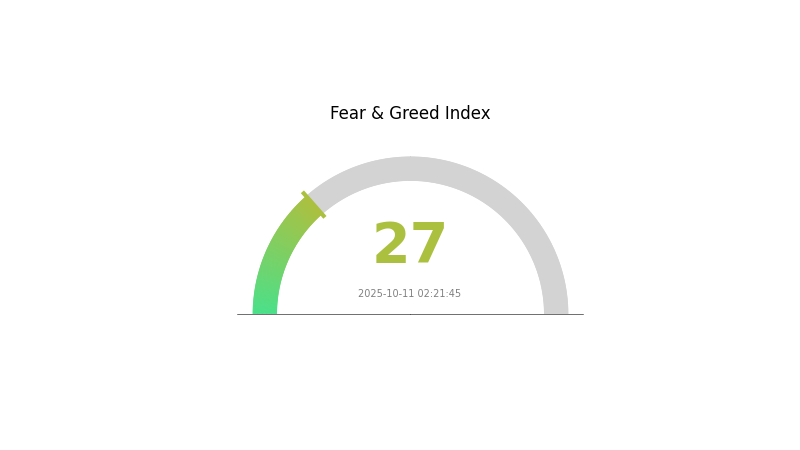

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 27. This indicates a cautious atmosphere among investors, potentially signaling undervalued market conditions. Historically, extreme fear has often presented buying opportunities for long-term investors. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and monitor market trends closely during these uncertain times.

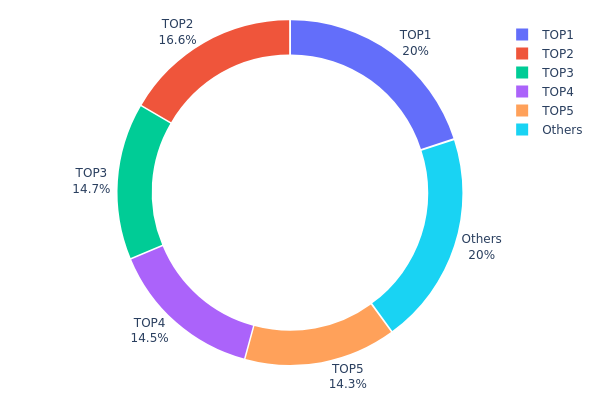

NAWS Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for NAWS. The top five addresses collectively control 80.03% of the total supply, with the largest holder possessing 20% alone. This level of concentration raises concerns about centralization and potential market manipulation.

Such a concentrated distribution can lead to increased volatility and susceptibility to large price swings. If any of these major holders decide to sell a significant portion of their holdings, it could trigger a sharp decline in NAWS's price. Conversely, coordinated buying from these addresses could artificially inflate the asset's value.

This distribution pattern suggests that NAWS's on-chain structure may be less stable and more vulnerable to the actions of a few key players. It also indicates a lower degree of decentralization, which could be a point of concern for investors seeking more widely distributed cryptocurrencies.

Click to view the current NAWS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa967...1d9347 | 2000000.00K | 20.00% |

| 2 | 0xe712...e5afaf | 1659000.00K | 16.59% |

| 3 | 0x9afc...0f3c4d | 1468438.00K | 14.68% |

| 4 | 0x40ea...bd5132 | 1450000.00K | 14.50% |

| 5 | 0xdd66...94976e | 1426399.90K | 14.26% |

| - | Others | 1996162.10K | 19.97% |

II. Key Factors Influencing NAWS Future Price

Supply Mechanism

- Central Bank Gold Purchases: Central banks, especially from emerging markets, are expected to continue increasing their gold reserves, significantly impacting the supply-demand dynamics.

- Historical Pattern: In recent years, central bank gold purchases have consistently exceeded 1,000 tons annually, doubling the average from 2016-2021.

- Current Impact: The ongoing trend of central bank gold accumulation is likely to provide sustained support for NAWS prices.

Institutional and Major Player Dynamics

- Institutional Holdings: ETFs have become a major source of gold demand, with inflows reaching 397 tons in the first half of 2025, the highest level since 2020.

- Corporate Adoption: Gold ETFs have seen record inflows, with $17.6 billion invested over a four-week period, indicating strong institutional interest.

- National Policies: Many countries are diversifying their foreign exchange reserves by increasing gold holdings, partly in response to geopolitical risks and financial sanctions.

Macroeconomic Environment

- Monetary Policy Impact: Expectations of interest rate cuts by the Federal Reserve and a weakening US dollar are supportive of higher NAWS prices.

- Inflation Hedging Properties: NAWS continues to be viewed as an effective hedge against inflation, especially in scenarios of persistent high inflation.

- Geopolitical Factors: Ongoing geopolitical tensions and trade disputes contribute to NAWS's appeal as a safe-haven asset.

Technical Developments and Ecosystem Building

- De-dollarization Trend: The global shift away from US dollar dominance is strengthening NAWS's position as an alternative store of value.

- Market Structure Changes: The increasing influence of ETFs on gold pricing, estimated to have grown by 50% in the past three years, is reshaping the NAWS market dynamics.

III. NAWS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00202 - $0.00249

- Neutral prediction: $0.00249 - $0.00289

- Optimistic prediction: $0.00289 - $0.00329 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00174 - $0.00351

- 2028: $0.00205 - $0.00388

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00397 - $0.00470 (assuming steady market growth)

- Optimistic scenario: $0.00470 - $0.00544 (assuming strong market performance)

- Transformative scenario: $0.00544 - $0.00600 (assuming breakthrough developments)

- 2030-12-31: NAWS $0.00544 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00329 | 0.00249 | 0.00202 | -2 |

| 2026 | 0.00333 | 0.00289 | 0.00203 | 13 |

| 2027 | 0.00351 | 0.00311 | 0.00174 | 22 |

| 2028 | 0.00388 | 0.00331 | 0.00205 | 29 |

| 2029 | 0.00435 | 0.00359 | 0.00255 | 41 |

| 2030 | 0.00544 | 0.00397 | 0.00258 | 55 |

IV. NAWS Professional Investment Strategies and Risk Management

NAWS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate NAWS tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to NAWS and the broader crypto market

- Set stop-loss orders to manage downside risk

NAWS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Gate.com's built-in wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for NAWS

NAWS Market Risks

- Volatility: Extreme price fluctuations common in the crypto market

- Liquidity: Limited trading volume may affect ease of buying/selling

- Competition: Other platforms offering similar services may impact NAWS's market share

NAWS Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting crypto projects

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax laws may impact NAWS token holders

NAWS Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability issues: Possible limitations in handling increased user activity

- Dependency on blockchain infrastructure: Vulnerabilities in the underlying blockchain could affect NAWS

VI. Conclusion and Action Recommendations

NAWS Investment Value Assessment

NAWS presents an innovative no-code platform for Web3 content creation and DePIN vouchers, with potential for long-term growth. However, it faces significant short-term risks due to market volatility and regulatory uncertainties.

NAWS Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the project

✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Conduct thorough due diligence and consider NAWS as part of a diversified crypto portfolio

NAWS Trading Participation Methods

- Spot trading: Buy and sell NAWS tokens on Gate.com

- Staking: Participate in staking programs if offered by the NAWS platform

- DeFi integration: Explore decentralized finance opportunities involving NAWS tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the stock price prediction for Nano Nuclear Energy in 2025?

The stock price for Nano Nuclear Energy in 2025 is predicted to be $47.41, based on current market analysis.

What meme coin will explode in 2025 price prediction?

Meme coins listed on major exchanges with high market caps are likely to explode in 2025. Predictions favor coins with strong exchange presence and significant price increases.

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach a price range of $90 to $120, based on current market trends and growth projections for the cryptocurrency.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, forecasted to reach $122,937. Chainlink follows with a peak prediction of $59.67.

Share

Content