Is Social Master & Branch (SMB) a good investment?: Analyzing the potential returns and risks of this emerging social media platform

Introduction: Investment Status and Market Prospects of Social Master & Branch (SMB)

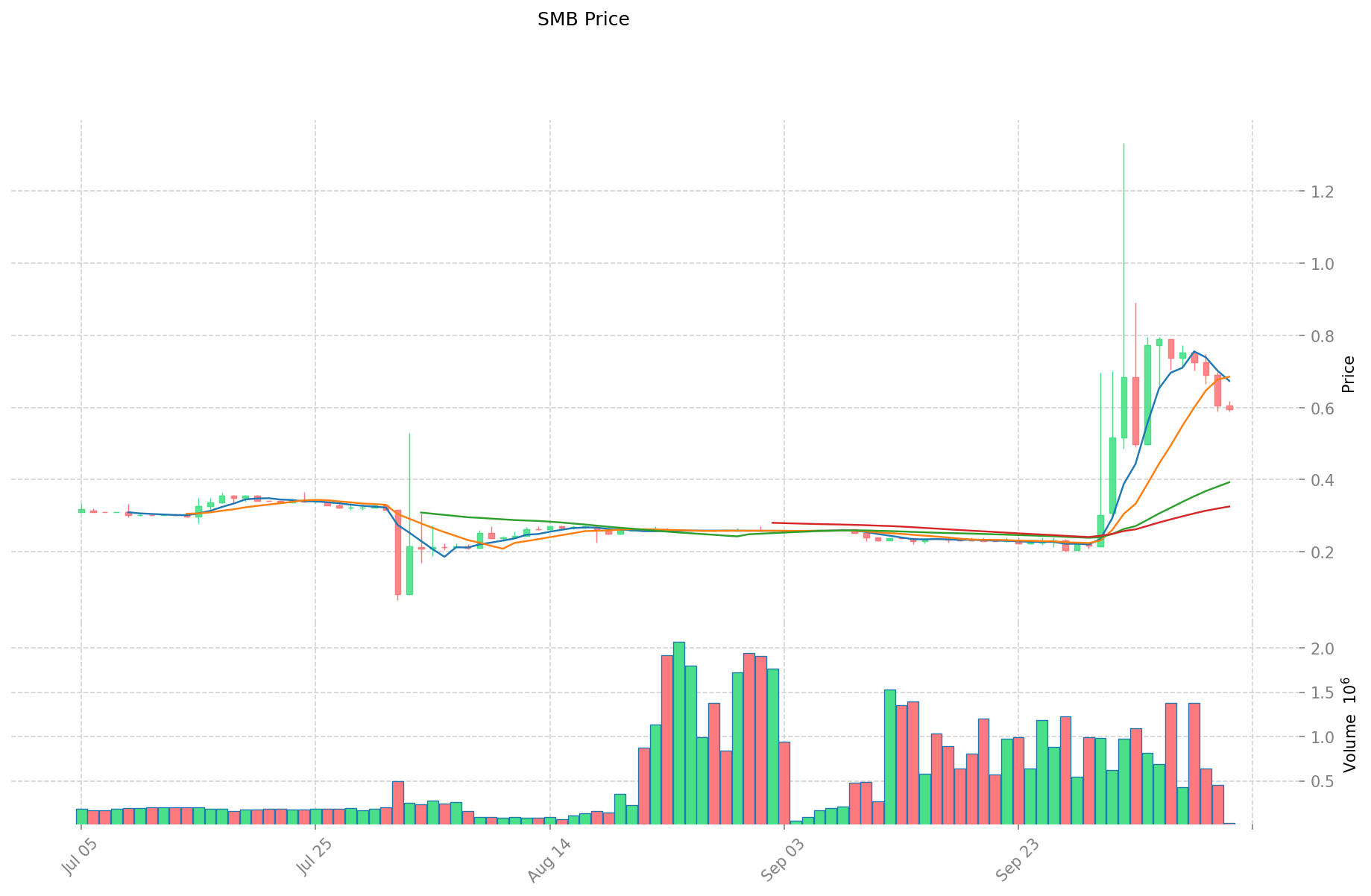

SMB is an important asset in the cryptocurrency field, having made significant achievements in Web3 commerce since its launch. As of 2025, SMB's market capitalization has reached $670,592,716.80, with a circulating supply of approximately 6,972,000 tokens, and a current price hovering around $0.59806. With its positioning as a "Web3 commerce solution", SMB has gradually become a focal point for investors discussing "Is Social Master & Branch (SMB) a good investment?" This article will comprehensively analyze SMB's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. SMB Price History Review and Current Investment Value

Social Master & Branch (SMB) investment performance

- 2025: Historical low price of $0.02844 on March 17 → Significant upside potential for early investors

- 2025: Historical high price of $1.3332 on October 2 → SMB price reached peak, showing over 4500% growth from low

- 2025: Current market cycle → Price dropped from $1.3332 high to $0.59806 current price

Current SMB investment market status (October 2025)

- SMB current price: $0.59806

- 24-hour trading volume: $15,568.34

- Circulating supply: 6,972,000 SMB

Click to view real-time SMB market price

II. Key Factors Influencing Whether Social Master & Branch (SMB) is a Good Investment

Supply Mechanism and Scarcity (SMB investment scarcity)

- Total supply of 1,121,280,000 SMB tokens → Impacts price and investment value

- Historical pattern: Supply changes have driven cryptocurrency prices in the past

- Investment significance: Scarcity is key to supporting long-term investment

Institutional Investment and Mainstream Adoption (Institutional investment in SMB)

- Institutional holding trend: Limited data available

- Notable companies adopting SMB → Could enhance its investment value

- Impact of national policies on SMB investment prospects

Macroeconomic Environment's Impact on SMB Investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → Potential "digital gold" positioning

- Geopolitical uncertainties → May increase demand for SMB investment

Technology and Ecosystem Development (Technology & Ecosystem for SMB investment)

- Polygon network: Enhances network performance → Increases investment appeal

- Web3 commerce focus: Expands ecosystem applications → Supports long-term value

- DeFi, NFT, and payment applications driving investment value

III. SMB Future Investment Prediction and Price Outlook (Is Social Master & Branch(SMB) worth investing in 2025-2030)

Short-term SMB investment outlook (2025)

- Conservative prediction: $0.32 - $0.45

- Neutral prediction: $0.45 - $0.60

- Optimistic prediction: $0.60 - $0.74

Mid-term Social Master & Branch(SMB) investment forecast (2027-2028)

- Market stage expectation: Growth phase with increasing adoption

- Investment return forecast:

- 2027: $0.58 - $0.98

- 2028: $0.79 - $1.03

- Key catalysts: Ecosystem expansion, partnerships, technological improvements

Long-term investment outlook (Is SMB a good long-term investment?)

- Base scenario: $0.65 - $1.23 (Steady growth and moderate market adoption)

- Optimistic scenario: $1.23 - $1.80 (Widespread adoption and favorable market conditions)

- Risk scenario: $0.30 - $0.60 (Market downturn or project setbacks)

Click to view SMB long-term investment and price prediction: Price Prediction

2025-10-12 - 2030 Long-term Outlook

- Base scenario: $0.65 - $1.23 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $1.23 - $1.80 (Corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $1.80 (In case of breakthrough progress in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $2.41 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.7356138 | 0.59806 | 0.3229524 | 0 |

| 2026 | 0.93357166 | 0.6668369 | 0.606821579 | 11 |

| 2027 | 0.9842512644 | 0.80020428 | 0.5761470816 | 33 |

| 2028 | 1.034984215752 | 0.8922277722 | 0.794082717258 | 49 |

| 2029 | 1.2526877921688 | 0.963605993976 | 0.84797327469888 | 61 |

| 2030 | 1.230043051310364 | 1.1081468930724 | 0.653806666912716 | 85 |

IV. How to invest in SMB

SMB investment strategy

- HODL SMB: Suitable for conservative investors

- Active trading: Relies on technical analysis and swing trading

Risk management for SMB investment

- Asset allocation ratio: Conservative / Aggressive / Professional investors

- Risk hedging solutions: Multi-asset portfolio + hedging tools

- Secure storage: Hot and cold wallets + hardware wallet recommendations

V. Risks of investing in SMB

- Market risk: High volatility, price manipulation

- Regulatory risk: Policy uncertainties in different countries

- Technical risk: Network security vulnerabilities, upgrade failures

VI. Conclusion: Is SMB a Good Investment?

- Investment value summary: SMB shows significant long-term investment potential, but with intense short-term price fluctuations.

- Investor recommendations: ✅ Beginners: Dollar-cost averaging + secure wallet storage ✅ Experienced investors: Swing trading + portfolio allocation ✅ Institutional investors: Strategic long-term allocation

⚠️ Note: Cryptocurrency investment carries high risks. This article is for reference only and does not constitute investment advice.

VII. FAQ

Q1: What is Social Master & Branch (SMB) and its current market status? A: Social Master & Branch (SMB) is a cryptocurrency positioned as a "Web3 commerce solution". As of October 2025, SMB's market capitalization is $670,592,716.80, with a circulating supply of approximately 6,972,000 tokens, and a current price of $0.59806.

Q2: What are the key factors influencing SMB's investment value? A: Key factors include its supply mechanism and scarcity, institutional investment and mainstream adoption, the macroeconomic environment, and technology and ecosystem development on the Polygon network.

Q3: What are the short-term and long-term price predictions for SMB? A: Short-term (2025) predictions range from $0.32 to $0.74. Long-term (2030) base scenario predicts $0.65 - $1.23, with an optimistic scenario of $1.23 - $1.80 and a potential high of $2.41.

Q4: How can one invest in SMB? A: Investors can adopt a HODL strategy for conservative investing or engage in active trading based on technical analysis. It's important to consider asset allocation ratios and use secure storage methods like hardware wallets.

Q5: What are the main risks of investing in SMB? A: The main risks include market volatility, potential price manipulation, regulatory uncertainties, and technical risks such as network security vulnerabilities or upgrade failures.

Q6: Is SMB considered a good long-term investment? A: SMB shows significant long-term potential, but comes with intense short-term price fluctuations. It may be suitable for investors willing to tolerate high risk for potentially high rewards, but careful consideration and risk management are essential.

Q7: How does SMB's performance compare to its historical highs and lows? A: In 2025, SMB reached a historical low of $0.02844 on March 17 and a high of $1.3332 on October 2, showing over 4500% growth from its low. The current price of $0.59806 represents a significant drop from the all-time high but still maintains substantial growth from the low.

Share

Content