WUSD vs TRX: Comparing Stablecoin Stability and Blockchain Performance

Introduction: WUSD vs TRX Investment Comparison

In the cryptocurrency market, the comparison between WUSD and TRX has been an unavoidable topic for investors. The two not only differ significantly in market cap ranking, application scenarios, and price performance but also represent different positioning in crypto assets.

WUSD (WUSD): Since its launch, it has gained market recognition for its focus on optimizing payment solutions for Web3 industry enterprise users.

TRX (TRX): Launched in 2017, it has been hailed as a platform for decentralized applications and entered the era of decentralized stablecoins in 2022.

This article will comprehensively analyze the investment value comparison between WUSD and TRX, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care most about:

"Which is the better buy right now?" Here is the requested report in English with the specified format:

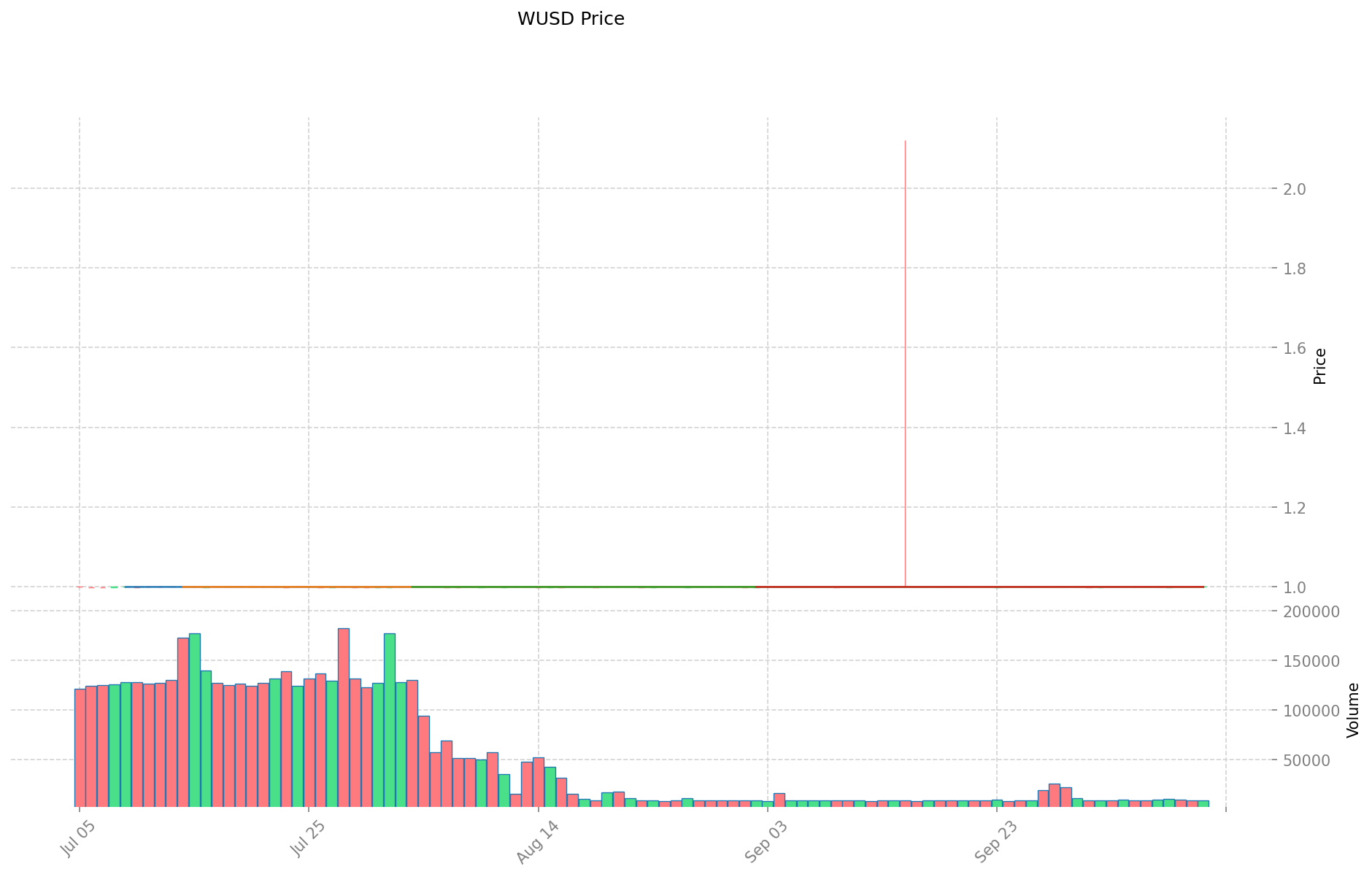

I. Price History Comparison and Current Market Status

WUSD and TRX Historical Price Trends

- 2024: WUSD reached its all-time high of $2.1209 on September 15, 2024.

- 2024: TRX hit its yearly high of $0.44948 on December 4, 2024, influenced by overall market optimism.

- Comparative analysis: During the 2024-2025 market cycle, WUSD dropped from its peak of $2.1209 to a low of $0.9974, while TRX showed more stability, maintaining a price range between $0.30 and $0.45.

Current Market Situation (2025-10-12)

- WUSD current price: $1.0001

- TRX current price: $0.31459

- 24-hour trading volume: WUSD $9,183.97 vs TRX $5,873,580.15

- Market Sentiment Index (Fear & Greed Index): 27 (Fear)

Click to view real-time prices:

- Check WUSD current price Market Price

- Check TRX current price Market Price

II. Core Factors Influencing WUSD vs TRX Investment Value

Supply Mechanism Comparison (Tokenomics)

- WUSD: A fiat-collateralized stablecoin pegged 1:1 to the US dollar

- TRX: Subject to TRON ecosystem expansion dynamics with no fixed supply cap

- 📌 Historical pattern: WUSD maintains stable value while TRX experiences price volatility based on network usage and DeFi activity.

Institutional Adoption and Market Applications

- Institutional holdings: TRX has attracted capital through "dinosaur coin rotation effect" in established blockchains

- Enterprise adoption: WUSD focuses on mainstream stablecoin adoption while TRX serves as utility token for TRON network

- Regulatory stance: WUSD's value depends heavily on regulatory compliance while TRX faces SEC litigation challenges

Technical Development and Ecosystem Building

- WUSD technical foundation: Designed to unlock stablecoin potential for mainstream adoption

- TRX technical development: Built on DPoS consensus mechanism with Java support and fee reduction through leasing model

- Ecosystem comparison: TRX powers a diverse ecosystem including DeFi (high TVL), NFT marketplaces (like APENFT), and GameFi applications, while WUSD focuses primarily on payment applications

Macroeconomic Factors and Market Cycles

- Inflation environment performance: WUSD designed to maintain stable value during inflation

- Macroeconomic monetary policy: TRX price affected by broader crypto market trends and capital flows

- Geopolitical factors: TRX serves as infrastructure for billions in daily transfers, with network utility increasing as transaction volume grows

III. 2025-2030 Price Prediction: WUSD vs TRX

Short-term Prediction (2025)

- WUSD: Conservative $0.63 - $1.00 | Optimistic $1.00 - $1.34

- TRX: Conservative $0.26 - $0.31 | Optimistic $0.31 - $0.47

Mid-term Prediction (2027)

- WUSD may enter a growth phase, with an estimated price range of $0.78 - $1.47

- TRX may enter a growth phase, with an estimated price range of $0.35 - $0.52

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- WUSD: Base scenario $0.90 - $1.76 | Optimistic scenario $1.76 - $1.83

- TRX: Base scenario $0.59 - $0.64 | Optimistic scenario $0.64 - $0.67

Disclaimer

WUSD:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.340134 | 1.0001 | 0.630063 | 0 |

| 2026 | 1.50945093 | 1.170117 | 0.95949594 | 17 |

| 2027 | 1.4737623615 | 1.339783965 | 0.7770746997 | 33 |

| 2028 | 1.8710083071225 | 1.40677316325 | 1.2238926520275 | 40 |

| 2029 | 1.884724345464187 | 1.63889073518625 | 1.37666821755645 | 63 |

| 2030 | 1.832279841938227 | 1.761807540325218 | 0.898521845565861 | 76 |

TRX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.4682474 | 0.31426 | 0.2608358 | 0 |

| 2026 | 0.46950444 | 0.3912537 | 0.367778478 | 24 |

| 2027 | 0.516454884 | 0.43037907 | 0.3529108374 | 36 |

| 2028 | 0.62491040964 | 0.473416977 | 0.29825269551 | 50 |

| 2029 | 0.7248960751824 | 0.54916369332 | 0.439330954656 | 74 |

| 2030 | 0.66888137846376 | 0.6370298842512 | 0.592437792353616 | 102 |

IV. Investment Strategy Comparison: WUSD vs TRX

Long-term vs Short-term Investment Strategies

- WUSD: Suitable for investors focused on payment scenarios and stable value preservation

- TRX: Suitable for investors seeking ecosystem potential and blockchain infrastructure exposure

Risk Management and Asset Allocation

- Conservative investors: WUSD: 70% vs TRX: 30%

- Aggressive investors: WUSD: 40% vs TRX: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risks

- WUSD: Vulnerability to USD fluctuations and global economic conditions

- TRX: High volatility and susceptibility to overall crypto market trends

Technical Risks

- WUSD: Scalability, network stability

- TRX: Mining power concentration, security vulnerabilities

Regulatory Risks

- Global regulatory policies have different impacts on both assets, with WUSD potentially facing more scrutiny as a stablecoin

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- WUSD advantages: Stable value, potential for mainstream adoption in payments

- TRX advantages: Established ecosystem, DeFi applications, high network utility

✅ Investment Advice:

- New investors: Consider a higher allocation to WUSD for stability

- Experienced investors: Balanced approach with exposure to both WUSD and TRX

- Institutional investors: Strategic allocation based on risk tolerance and portfolio objectives

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between WUSD and TRX? A: WUSD is a fiat-collateralized stablecoin pegged to the US dollar, while TRX is the native cryptocurrency of the TRON network. WUSD focuses on stable value and payment solutions, whereas TRX powers a diverse ecosystem including DeFi, NFTs, and dApps.

Q2: Which asset is more suitable for long-term investment? A: For long-term investment, TRX may offer higher potential returns due to its ecosystem growth and adoption. However, WUSD provides more stability and is better suited for those seeking to preserve value or hedge against market volatility.

Q3: How do regulatory risks compare between WUSD and TRX? A: WUSD, as a stablecoin, may face more regulatory scrutiny and compliance requirements. TRX, while less directly impacted by stablecoin regulations, faces its own challenges, including ongoing SEC litigation.

Q4: What factors could drive the price of TRX in the future? A: Factors that could drive TRX's price include increased adoption of the TRON network, growth in DeFi and dApp usage, institutional investment, and overall crypto market trends.

Q5: Is WUSD a good hedge against inflation? A: WUSD is designed to maintain a stable value pegged to the US dollar, which can provide some protection against inflation in the crypto market. However, it's still subject to the inflation rate of the US dollar itself.

Q6: How does the market capitalization of WUSD compare to TRX? A: As of 2025-10-12, specific market cap data wasn't provided. However, TRX generally has a larger market capitalization due to its established position in the crypto market, while WUSD's market cap is tied to its circulating supply as a stablecoin.

Q7: What are the key ecosystem developments to watch for each asset? A: For WUSD, watch for increased adoption in payment solutions and potential partnerships with traditional financial institutions. For TRX, keep an eye on the growth of DeFi protocols, NFT marketplaces, and new dApps built on the TRON network.

Share

Content